Insights into Gold Price Forecast for next week and DXY Movements for the Coming Week

As we look ahead to the Gold Price Forecast for next week, it’s crucial to examine the dynamics surrounding gold prices and the trajectory of the DXY (US Dollar Index). These factors play a significant role in shaping investment strategies and making informed decisions. Let us now dive deep into an insightful exploration of the forthcoming predictions encompassing the movements of both the esteemed Gold and the influential DXY. By delving into these forecasts, we aim to uncover their probable trajectories and, in turn, shed light on the potential ramifications they might bear upon the vast landscape of trading opportunities that await.

DXY Trends and Gold Price Forecast for next week

The DXY has been displaying a robust upward trend, currently positioned around the 104.15 level. If the DXY experiences a decline, the potential for continued upward movement remains viable, even reaching levels around 103.5-103.60, which serve as crucial support points. Conversely, in the event of a DXY uptrend, a potential drop is anticipated near the 104.5 level, at a point of DXY resistance. Such shifts can mark the initiation of trend reversals, necessitating vigilant monitoring for traders.

Technical Outlook for Gold Price Forecast for next week

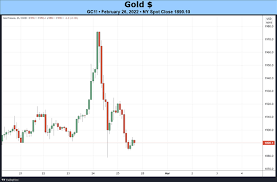

When predicting the Gold Price Forecast for next week, Currently hovering around 1914, Gold faces two distinct scenarios in the coming week. Should Gold prices retreat from this zone, it could approach the 1903-1904 range. Conversely, if Gold continues its upward trajectory, it may target levels between 1921 and 1925. An interesting development arises if the substantial resistance at 1925 is breached with notable bullish momentum—this could propel Gold to the range of 1930-1935. The critical juncture at 1914-1915 holds significance; a continuation of rejection here may eliminate the 1985 target. However, persistent buying pressure in this range could set sights on the 1930 level, warranting cautious observation of market behaviour.

Fundamental Factors Impacting Gold

The fundamental landscape further adds depth to our analysis. The outcome of the Non-Farm Payrolls (NFP) report, a key labour market indicator, could trigger fluctuations in Gold prices. Positive NFP data may prompt a decline in Gold, potentially retreating to the 1880 range. Various factors, including vaccine developments and earnings reports, will also come into play. Should unfavourable unemployment figures lead to a weakened USD, it could set the stage for a bullish run towards 1880. Conversely, negative NFP data might solidify the prospect of Gold reaching the 1930-1935 range.

Strategies for Monday (28 th of AUG ) Gold Trading

When observing Gold’s behaviour on Monday, multiple scenarios emerge. If Gold at 1914 takes an upward trajectory, consider a potential selling opportunity within the 1921-1925 range. Evaluating selling pressure is crucial in making an informed decision. Alternatively, if Gold retreats to 1903-1904 following a rejection at 1914-1915, a buying opportunity of around 50/60 pips could arise, assuming a decrease in selling pressure. Furthermore, the 1900-1898 levels present another potential buying opportunity.

Summary:

In conclusion, the upcoming gold week holds a mix of technical and fundamental influences on gold prices and DXY trends. While a fundamental approach suggests a bearish stance for Gold, the labour market data’s impact on sentiment could alter the landscape. Precise level evaluation remains integral to effective decision-making, so trade with proper risk management as market conditions evolve. It is of utmost importance to duly acknowledge that the perspectives encapsulated within these insights remain inherently personal in nature. Furthermore, it is imperative to underscore that adept manoeuvring through these intricate trends necessitates the astute incorporation of judicious risk management strategies.